Trends and predictions for the recruitment market in 2024

The recruitment industry continues to change thanks to technological advancements, economic dynamics, and societal shifts. Expected or not, 2023 has proven challenging for many firms across every industry, and all businesses will be looking ahead to next year with a renewed focus on predicting what is to come.

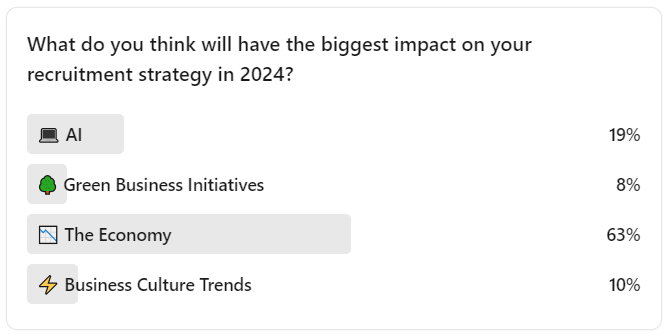

When we asked our LinkedIn network what they thought would have the biggest impact on their 2024 recruitment plans, the economy was the clear winner with over 60% of the vote. It seems that businesses are apprehensively waiting to see what the economy and the 2024 UK general election have in store.

AI is clearly on some companies' minds, as well as business culture trends such as menopause awareness, flexible working, employee wellbeing, and compensating candidates for their interview time. However, it seems despite calls for urgent climate action and widespread focus on climate regulations, green business initiatives aren't as much of a priority for firms as we head into the new year.

From adopting generative AI to what the UK general election might mean for the recruitment market, we’ve explored some key trends that we’re likely to see in 2024.

Jump to

Using Generative AI for recruitment and beyond

Green job opportunities are growing as climate risk is in the spotlight

How will the 2024 general election affect the UK job market?

Also on the radar: Data-driven recruitment | Paying for candidates' time | Flexible working

Using Generative AI for Recruitment and Beyond

Generative AI (GenAI - artificial intelligence capable of generating text, images, or other media, using generative models) is making waves across many aspects of every industry. For example:

AI in Investment Management

In Investment Management, generative AI could be used for writing portfolio performance reports, customised portfolio and stock advice, enhancing risk assessments, generating predictions, and much more.

Kirstie Burn, MERJE Director specialising in governance recruitment, observed,

“The investment management industry can benefit in many ways from embracing generative AI, but that doesn’t mean there aren’t risks involved too. It will be vital to employ commercially-minded and risk-aware leaders who can balance the digital and operational transformation involved in embracing AI with the potential risks of security, accountability, reliability, etc.”

AI in Insurance

On implementing the use of AI in the insurance sector, Adam Jones, Actuarial Principal Consultant and insurance industry expert, commented,

“AI is likely to be embraced rapidly in the insurance industry thanks to its capabilities when it comes to identifying fraud, improving customer experience, and creating more efficient processes.

“With applications from product development to behaviour analysis, companies will need to recruit and upskill actuaries, analysts, and technology experts who can work together to get the best out of AI in the insurance industry.”

AI in Credit Risk

In credit risk, AI can be used to generate predictive insights, speed up credit risk assessments, provide real-time financial advice, deliver instantaneous alerts to mortgage applicants about missing documents, and enhance the productivity of customer-facing teams, amongst many other things.

Ellie Sykes, Director and specialist in recruiting in the credit risk space, commented on the use of AI in the credit risk business function,

“As we tend to see with most digital transformation, due to the rigidity of legacy processes, systems, and frameworks, big banks and larger financial services firms may struggle to keep up with fintechs and SMEs when it comes to adopting AI.

“With declining customer loyalty as time goes on, the need for deeper customer relationships, better user experiences, and greater financial empowerment is growing, all of which can be aided with AI. The businesses which recognise this and allow their teams to explore how AI can help them will ultimately get ahead.”

AI impacts every industry

With all this in mind, business leaders putting their hiring strategies together for 2024 need to recognise the importance of hiring job roles, experience, and skillsets which lend themselves to embracing AI and optimising its take-up within their business.

Some key hires to consider are:

Machine Learning Engineer

Data Scientist

Business Intelligence Developer

Data Analyst

Chief AI Officer

And important skills to look out for:

Adaptability

Problem-Solving

Data Literacy, including data modelling, data warehousing, data processing, etc.

Machine Learning

Continuous Improvement mindset

Collaboration abilities

How will AI affect recruitment processes in 2024?

The outlook isn’t favourable according to our recent LinkedIn poll, with 54% of voters saying they think AI will have a negative impact on recruitment.

Having said that, jobseekers and talent teams are already embracing generative AI in their day-to-day for the likes of writing CVs and cover letters, obtaining interview questions and answers, writing job descriptions and adverts, and much more.

"AI could lead to more ill-prepared candidates as data returned by AI tools isn't always 100% accurate"

As either side of the hiring process looks to generative AI for help, the impacts this could have are wide-reaching. MERJE Marketing Manager and ex-recruiter Beth shared her thoughts,

“From a hiring manager point of view, it could be more difficult to identify the good CVs from the bad if they’re all written and optimised with AI. This may end up leading to more phone/video/f2f interviews taking place which takes up more business time.”

This point itself generates more questions about whether AI will ultimately be beneficial for employment activities or not.

The key positive and negative impacts we see AI having on the recruitment process are:

Candidates, CVs and Job Applications

Candidates will be able to generate personalised CVs and cover letters much faster, enabling them to apply to more roles in a shorter space of time.

This will also mean that CVs submitted to roles are on a more level playing field, with less being rejected based on bad spelling, grammar, formatting, or other conscious/unconscious bias. Ultimately this could lead to a more diverse range of applicants reaching interview stage.

Candidates will also be able to harness AI to identify a wider abundance and more specific search results for job opportunities, potentially leading again to more job applications but also to more targeted and relevant applications too.

Candidates can more quickly and easily research pertinent interview questions and prepare answers, as well as information about the industry, role, and company they’re applying to.

Conversely, this could lead to more ill-prepared candidates as data returned by AI tools isn’t always 100% accurate.

Hiring Processes

Hiring teams can also embrace generative AI for generating interview questions, job descriptions, job adverts, social media posts, etc. which will save time and enable central talent functions to carry out the recruitment process with less input from department managers.

However, without proper human reviews of AI-generated content, businesses risk sounding generic, and candidates will see through their impersonal approach which could damage employer brands.

Recruitment teams could also rely more on AI to improve steps of the hiring process such as CV and applicant screening (including reviewing candidates’ social media presence), which again will save company time but could lead to missed candidates and inadvertent discrimination depending on what data the AI algorithms are trained on.

Ultimately, both jobseekers and hiring businesses should be wary of relying too much on generative AI. Personalisation and human connection are key to success in today’s market, and generative AI can only replicate that to a certain extent.

Furthermore, generative AI tools are popping up in every corner of the market and tempting individuals and professionals with their promises of ease, efficiency, greater access to data, etc. But with little regulation and many adopters not carrying out due diligence before using these new technologies, the risks of badly trained AI wreaking havoc, increased cybersecurity threats, and loss of privacy are intensifying faster than ever.

Companies must ensure they take a measured and strategic approach to involving AI as part of their regular operational processes.

Green job opportunities are growing as climate risk is in the spotlight

According to PwC’s Green Jobs Barometer, the number of green jobs within financial services and insurance in 2023 has increased by 29.4% since last year, with green jobs now accounting for 2.2% of all job advertisements in these sectors.

Interestingly, the green jobs barometer reports that FS and insurance has seen the largest amount of growth, with most other industries seeing fewer green job advertisements year-on-year.

This demonstrates a clear trend: being environmentally-conscious is a major topic for UK financial services businesses.

"60% of real estate firms surveyed say they lack data, processes, and internal controls necessary to meet compliance standards for ESG regulations"

The increased focus on environmental and social governance (ESG) in the financial sector could be attributed to a variety of factors – pressure from consumers who are more inclined towards climate-conscious businesses, increased climate-related regulations, or maybe a transition to a purpose-driven or “green business” ethos.

Regardless of the driving forces behind it, it comes as no surprise given the European Environment Agency reports that weather- and climate-related extremes caused economic losses of assets in the EU Member States estimated at EUR 111.7 billion in 2021 and 2022 alone (nearly 1/5th of all losses between 1980 and 2022).

This is why 2024 will likely see even more green jobs created and advertised across all areas of financial services.

Green jobs in Commercial Real Estate

Deloitte have reported that 60% of real estate firms surveyed say they lack data, processes, and internal controls necessary to meet compliance standards for ESG regulations.

With that in mind, we’ll likely see a push on hiring roles and skillsets which can better equip companies to reach these standards. Commercial Real Estate firms will be on the lookout for data professionals, compliance and regulation experts, and transformation and change leaders who can bring their businesses up to scratch.

Green jobs in Insurance

Climate-related activities, from freak weather events to new regulations, impact every area of insurance.

Changing life spans due to dramatic weather shifts, more frequent weather events such as floods and fires, and greater focus on compliance with climate regulations will affect not just life insurance, pensions, and general insurance products, but insurance business operations too.

Banks and insurers are developing climate-related stress tests and other risk management tools to build a better understanding of their exposure to climate risks. As climate-focused risk management strategies and frameworks become more commonplace in 2024, Actuaries can expect to be more involved in developing these than they may have been previously.

Adam commented,

“An actuary’s technical skillset lends itself well to developing a company’s climate risk strategy. Creating climate risk models, climate scenario analysis, carbon footprint calculations, climate-related investment analysis, and regression analysis all play to an actuary’s strengths in data and statistical analysis.”

Green jobs in Credit Risk

Nuhaa Mohamed, another of our credit risk recruitment experts, has noticed the increase in climate-related and green job roles recently,

“More and more businesses are looking to fortify their operations against climate risks. With this being a newer trend, there isn’t a solid climate risk skillset in existence which means they’re looking for relevant and transferable skills from other business functions.

“We’ve seen that credit risk professionals tick a lot of those boxes. Data and statistical analysis, data modelling, and an inquisitive and analytical mindset all feature heavily in the credit risk professional’s repertoire and transfer perfectly to a climate risk role.”

Nuhaa has also confirmed that credit risk candidates themselves are keen to gain exposure to climate risk and frequently ask about businesses or job opportunities where they might gain experience in this area.

This tells us that candidates also see the value in their transferable skills and are demonstrating an interest in and passion for the climate risk area, which is a solid foundation for a great addition to any team.

How will the 2024 General Election affect the UK Job Market?

As the 2024 UK General Election looms large, businesses find themselves at a crossroads, grappling with not only political uncertainties but also a complex web of economic indicators and shifting labour market dynamics.

The 2024 election comes at a crucial juncture when the UK economy continues to face headwinds from higher interest rates aimed at controlling inflation. In light of these challenges, employer hiring appetite has seen a recent dip, although it remains above pre-pandemic levels according to ONS data.

Now, while the labour market shows signs of softening, employers seem cautious about shedding staff, possibly influenced by the difficulty experienced in hiring in recent times. This has boosted companies’ desires to retain employees; a much more cost-effective strategy than hiring and training new team members.

"It’s vital for businesses to keep an eye on possible changes the parties may make to laws, regulations, and policies affecting employment and immigration"

The uncertainty lying before the 2024 UK general election means many businesses will delay major decisions or changes. New acquisitions, hiring, operational changes, investments, and more will be put on hold until the election outcome and its after-effects are known.

With wide-ranging focuses for each political party, such as zero-hour contract bans, extending flexible working to all, and apprenticeship levy reforms, the election results could have a dramatic effect on the overall economy and the UK job market.

Employment rights, recruitment methods, work visas, and discrimination laws could all potentially be impacted, meaning it’s vital for businesses to keep an eye on possible changes the parties may make to laws, regulations, and policies affecting employment and immigration in order to inform their recruitment strategies for 2024 and beyond.

Ellie adds,

“The mortgage market is always a good indicator for the wider financial services sector. Whatever trends make waves through FS can usually be seen in their early stages in the mortgage space, so businesses will be keeping a close eye on how the mortgage market alters following the election results and what that might mean for the wider financial services arena.”

Also on the radar…

Data-driven recruitment

Generative AI isn’t the only technological advancement affecting businesses and their hiring plans. As more organisations embrace advanced analytics and data-driven insights, they will be better equipped to build detailed recruitment strategies based on thorough resource planning, an improved understanding of where to find relevant candidates, and greater knowledge of how to optimise the hiring process and beat competitors in attracting talent.

Paying for Candidates’ Time

The LinkedIn News team's annual list of Big Ideas for 2024 includes a notable mention – companies compensating job applicants for their time in the interview process.

Examples of this practice have popped up in recent years, including FoodShare Toronto offering $75 for face-to-face interviews, Changing the Flow compensating everyone who interviews for a job at their company, and UK-based Zero Waste Club, providing ~£100 for a two-hour workshop.

Advocates argue that paying candidates for their time acknowledges the often lengthy hiring process and may prompt employers to expedite decisions.

This trend could grow even more in 2024 as the UK job market remains uncertain and socially conscious businesses look for additional benefits to make them stand out from the crowd.

Flexible Working

A “trend” that isn’t waning. Companies are calling for workers to return to the office, as demonstrated in Indeed’s 2024 UK Jobs & Hiring Trends report which states that the number of job postings mentioning remote or hybrid terms has declined to 14.4% (from 16.3% in May).

However, the demand for flexible working from candidates is not decreasing, and with the CIPD reporting that flexible working has proven to reduce staff turnover significantly (by 87%), it seems that those who continue to push the back-to-office agenda in 2024 will likely end up losing or missing out on strong candidates.

Gemma Cardew, Senior Consultant in Finance & Audit recruitment, adds,

“I do think more companies will be pushing back on home working in 2024. Whether that will work for them remains to be seen but it raises a lot of questions about the future of remote work dynamics in the UK.”

All in all, it's clear that more changes are on the horizon for the recruitment industry in 2024. From AI integration to a focus on social and environmental values, navigating these trends calls for adaptability and a positive approach from both employers and jobseekers.

While challenges will arise, there's immense potential for innovation in all business areas. So, here's to embracing change, using technology wisely, and staying agile in the dynamic world of talent acquisition.

.png)